POSITIONS

All positions continue to hold key levels and MA’s. Just letting them work.

Was stopped on GEV. Just chopping around in this base. Today will mark the end of the 5th week in this base.

If you look at what it looked like before it made it’s recent move, it had similar choppy action before tightening at the top of the base. Would like to see it do something similar if it were to continue higher.

Took a loss on DAVE as well.

Tried an add on CLS and decided to take it off in to the close given a lot of stocks were fading and markets looking weak as well as being extended. It’s now gapping with the market. Is what it is, could have gapped the other way with AVGO reaction and we manage risk first. Has held really well and a nice ascending base look. I still have a 25% position so may just stick with that. Could still be buyable through the previous highs.

Seems to be a similar setup theme of late. AFRM had similar setup just before earnings, RDDT and ALAB look that way now.

I was asked if I could share my scanning process. To be honest there isn’t much to it. At the moment I use Deepvue and use their preset scans (Deepvue Leaders and Liquid Leaders primarily).

If you don’t have Deepvue below are some scans I used to use in Finviz:

Gappers - this one is for biggest movers on volume, looking for earnings gaps.

I’m essentially looking for stocks showing relative strength, in strong themes, and preferably with decent earnings/sales estimates with big bases. I have changed my focus recently and moved more towards liquid leaders with higher daily dollar volume and away from more small cap momentum plays, just because I tend to do better with them.

For the most part it’s just going through the scans each night and adding any interesting charts to my watchlist. then going through my watchlist each day to look for setups. I’m looking for stocks that are either making big bases (preferably after already making a big move) or that have already broken out of them to track for continuation setups. I want to try and buy as close to the base as possible. I also track strong earnings gaps to watch for setups that occur further down the line.

Hope that helps. Would be happy to clarify more if not.

MARKET

QQQ SPY remain extended and now gapping on AVGO earnings. Be interesting to see how the gap up is treated and how semi’s in general react as they have been weak for a while. Could it spark a semi’s revival and keep the market trend alive?! Or do we fade the gap?!

IWM

Continues to act weak, losing the 20ema

IWP

Mid-cap growth. This seems to do a better job of tracking the more growthier names that most of us play in than the IWM. Just consolidating it’s recent move. Even a pullback to the 10WMA (red stair step) would be healthy.

Short term FOMO continues to cool off and now close to levels that we often see a bounce

Seems we’re at an interesting spot really. Indexes and many leading stocks are short term extended. NAAIM is at overbought levels, but short term FOMO down near oversold levels. We did see a lot of breakout squats yesterday. And now the market gapping this morning.

On the one hand I see lots of stocks acting well and some building out potential short pivots. It’s just whether they can push from here or they need more time and a bigger bases. On the other hand I see a lot of extended stocks that need basing but could also just continue to run.

I have decent exposure in what I would class as leading names. So probably wise for me to take my foot off the gas and let these work, and see where we go from here.

With many stocks extended, seems we're at a spot where you need to focus on type of trader you are. Are you trimming? Holding? or both? I'm trying to move more to catching bigger moves and when I look at the weeklies, my stocks look fine. I'm okay with holding through a pullback.

STOCKS ON WATCH

As always, it’s important to keep up your scanning routine and identify stocks with potential setups. Not only does this ensure that you’re ready but it’s important feedback on the health of the market.

Are there lots of setups and are they breaking out and following through?! If so, hit the gas.

Are there a lack of setups and/or lots of failed moves?! If so, hit the brakes.

Mentioned GEV above which is a major focus.

RVLV

This is holding really well. Added benefit of low float and highly shorted.

UEC

Uranium could be a strong theme moving forward.

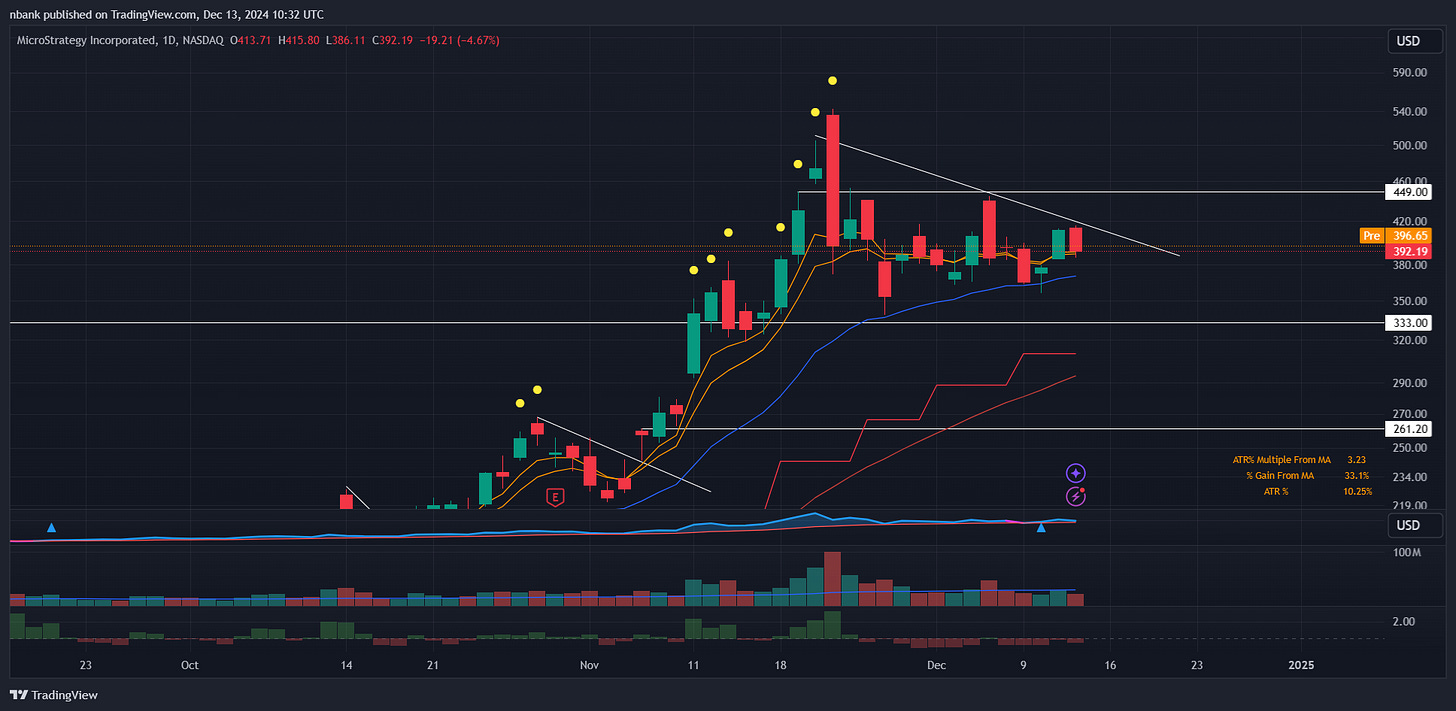

MSTR

Still think this is building out well on low volume after the exhaustion candle

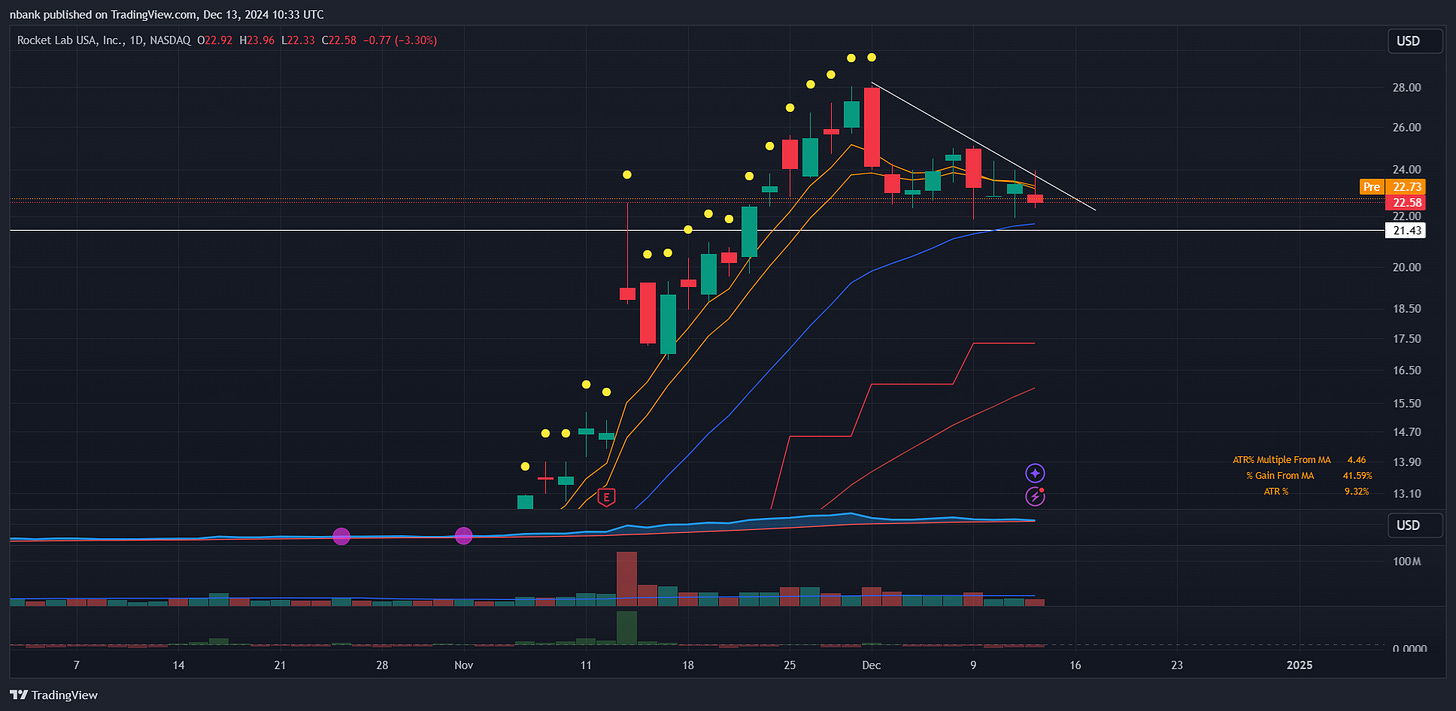

RKLB

Digesting the monster move well

NVDA

interesting spot here. Double inside under a cluster of MA’s. Been basing since June. See if AVGO earnings can kick the semi’s back in to gear.

Thanks . ARM looks good too